What Qualifies As An Expense . We have discontinued publication 535, business expenses; expense is the cost of running a business. This includes money spent on items such as rent, office supplies, and salaries for. Learn more about how you can reduce your taxes today. business expenses are deductible and lower the amount of taxable income. guide to business expense resources. deductible business expense categories include things like home office expenses. understanding business expense categories is crucial for better financial management and regulatory compliance. The total of business expenses is subtracted from revenue to arrive at a business' total amount of taxable. an expense is a type of expenditure that flows through the income statement and is deducted from revenue to arrive at net income. Due to the accrual principle in accounting, expenses are recognized when they are incurred, not necessarily when they are paid for.

from www.educba.com

understanding business expense categories is crucial for better financial management and regulatory compliance. We have discontinued publication 535, business expenses; business expenses are deductible and lower the amount of taxable income. deductible business expense categories include things like home office expenses. Due to the accrual principle in accounting, expenses are recognized when they are incurred, not necessarily when they are paid for. an expense is a type of expenditure that flows through the income statement and is deducted from revenue to arrive at net income. This includes money spent on items such as rent, office supplies, and salaries for. expense is the cost of running a business. guide to business expense resources. The total of business expenses is subtracted from revenue to arrive at a business' total amount of taxable.

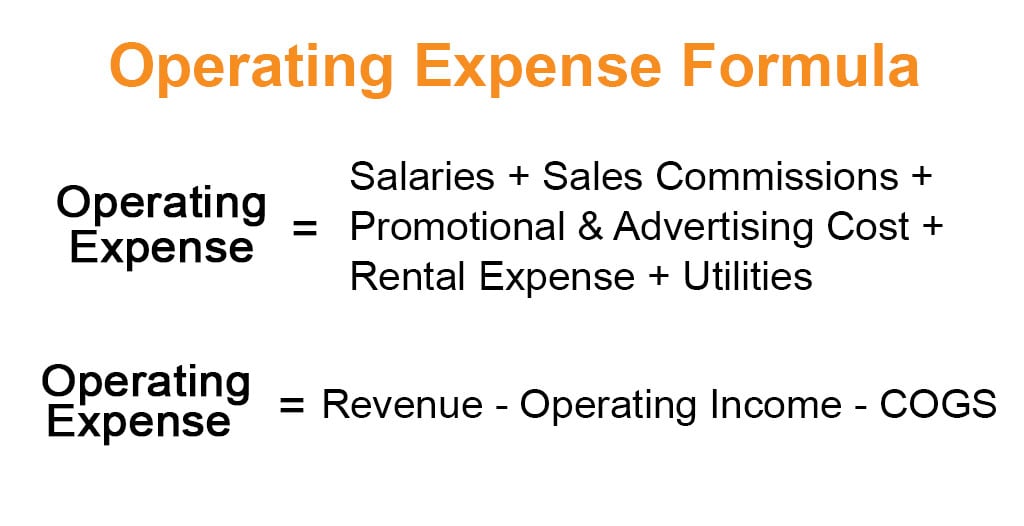

Operating Expense Formula Calculator (Examples with Excel Template)

What Qualifies As An Expense an expense is a type of expenditure that flows through the income statement and is deducted from revenue to arrive at net income. understanding business expense categories is crucial for better financial management and regulatory compliance. We have discontinued publication 535, business expenses; an expense is a type of expenditure that flows through the income statement and is deducted from revenue to arrive at net income. Due to the accrual principle in accounting, expenses are recognized when they are incurred, not necessarily when they are paid for. business expenses are deductible and lower the amount of taxable income. This includes money spent on items such as rent, office supplies, and salaries for. guide to business expense resources. expense is the cost of running a business. deductible business expense categories include things like home office expenses. Learn more about how you can reduce your taxes today. The total of business expenses is subtracted from revenue to arrive at a business' total amount of taxable.

From happay.com

Guide to Simplify Your Employee Expense Reimbursement Process What Qualifies As An Expense This includes money spent on items such as rent, office supplies, and salaries for. Learn more about how you can reduce your taxes today. The total of business expenses is subtracted from revenue to arrive at a business' total amount of taxable. Due to the accrual principle in accounting, expenses are recognized when they are incurred, not necessarily when they. What Qualifies As An Expense.

From www.sampletemplates.com

FREE 10+ Sample Lists of Expense in MS Word PDF What Qualifies As An Expense This includes money spent on items such as rent, office supplies, and salaries for. guide to business expense resources. expense is the cost of running a business. Learn more about how you can reduce your taxes today. We have discontinued publication 535, business expenses; business expenses are deductible and lower the amount of taxable income. understanding. What Qualifies As An Expense.

From happay.com

5 Steps to Automate Your Expense Approval Process Happay What Qualifies As An Expense Learn more about how you can reduce your taxes today. The total of business expenses is subtracted from revenue to arrive at a business' total amount of taxable. understanding business expense categories is crucial for better financial management and regulatory compliance. guide to business expense resources. an expense is a type of expenditure that flows through the. What Qualifies As An Expense.

From efinancemanagement.com

What is Expense? Definition and Meaning What Qualifies As An Expense Due to the accrual principle in accounting, expenses are recognized when they are incurred, not necessarily when they are paid for. expense is the cost of running a business. The total of business expenses is subtracted from revenue to arrive at a business' total amount of taxable. an expense is a type of expenditure that flows through the. What Qualifies As An Expense.

From www.wellybox.com

What are Business Expense Categories? Full Expense Categories List What Qualifies As An Expense business expenses are deductible and lower the amount of taxable income. deductible business expense categories include things like home office expenses. guide to business expense resources. Due to the accrual principle in accounting, expenses are recognized when they are incurred, not necessarily when they are paid for. understanding business expense categories is crucial for better financial. What Qualifies As An Expense.

From marketbusinessnews.com

What is an expense? Definition and meaning Market Business News What Qualifies As An Expense an expense is a type of expenditure that flows through the income statement and is deducted from revenue to arrive at net income. The total of business expenses is subtracted from revenue to arrive at a business' total amount of taxable. expense is the cost of running a business. guide to business expense resources. We have discontinued. What Qualifies As An Expense.

From www.patriotsoftware.com

Employee Expense Reimbursement Definition, Taxes, Policy What Qualifies As An Expense guide to business expense resources. business expenses are deductible and lower the amount of taxable income. Learn more about how you can reduce your taxes today. We have discontinued publication 535, business expenses; an expense is a type of expenditure that flows through the income statement and is deducted from revenue to arrive at net income. . What Qualifies As An Expense.

From www.deskera.com

Expenses in Accounting Definition, Types, and Examples What Qualifies As An Expense Due to the accrual principle in accounting, expenses are recognized when they are incurred, not necessarily when they are paid for. Learn more about how you can reduce your taxes today. The total of business expenses is subtracted from revenue to arrive at a business' total amount of taxable. We have discontinued publication 535, business expenses; deductible business expense. What Qualifies As An Expense.

From smith.ai

Operating Expenses Formula How To Calculate and Reduce Expenses Smith.ai What Qualifies As An Expense This includes money spent on items such as rent, office supplies, and salaries for. Learn more about how you can reduce your taxes today. expense is the cost of running a business. an expense is a type of expenditure that flows through the income statement and is deducted from revenue to arrive at net income. deductible business. What Qualifies As An Expense.

From fabalabse.com

What qualifies as an education expense? Leia aqui What counts as What Qualifies As An Expense This includes money spent on items such as rent, office supplies, and salaries for. Learn more about how you can reduce your taxes today. We have discontinued publication 535, business expenses; deductible business expense categories include things like home office expenses. an expense is a type of expenditure that flows through the income statement and is deducted from. What Qualifies As An Expense.

From www.educba.com

Operating Expense Formula Calculator (Examples with Excel Template) What Qualifies As An Expense expense is the cost of running a business. We have discontinued publication 535, business expenses; guide to business expense resources. This includes money spent on items such as rent, office supplies, and salaries for. deductible business expense categories include things like home office expenses. an expense is a type of expenditure that flows through the income. What Qualifies As An Expense.

From templatearchive.com

30 Effective Monthly Expenses Templates (& Bill Trackers) What Qualifies As An Expense an expense is a type of expenditure that flows through the income statement and is deducted from revenue to arrive at net income. Learn more about how you can reduce your taxes today. We have discontinued publication 535, business expenses; The total of business expenses is subtracted from revenue to arrive at a business' total amount of taxable. . What Qualifies As An Expense.

From www.pinterest.com

Selling, General and Administrative Expenses All You Need To Know What Qualifies As An Expense We have discontinued publication 535, business expenses; This includes money spent on items such as rent, office supplies, and salaries for. The total of business expenses is subtracted from revenue to arrive at a business' total amount of taxable. expense is the cost of running a business. guide to business expense resources. an expense is a type. What Qualifies As An Expense.

From www.stampli.com

Where’s Your Money Going? Business Expense Accounts Explained What Qualifies As An Expense guide to business expense resources. We have discontinued publication 535, business expenses; Due to the accrual principle in accounting, expenses are recognized when they are incurred, not necessarily when they are paid for. This includes money spent on items such as rent, office supplies, and salaries for. an expense is a type of expenditure that flows through the. What Qualifies As An Expense.

From findecta.com

What Qualifies As An HSA Eligible Expense? Make a Living Club What Qualifies As An Expense expense is the cost of running a business. The total of business expenses is subtracted from revenue to arrive at a business' total amount of taxable. Learn more about how you can reduce your taxes today. We have discontinued publication 535, business expenses; deductible business expense categories include things like home office expenses. business expenses are deductible. What Qualifies As An Expense.

From www.indeed.com

What Are Business Expenses? Definition, Types and Categories What Qualifies As An Expense business expenses are deductible and lower the amount of taxable income. The total of business expenses is subtracted from revenue to arrive at a business' total amount of taxable. Learn more about how you can reduce your taxes today. an expense is a type of expenditure that flows through the income statement and is deducted from revenue to. What Qualifies As An Expense.

From franqreggie.pages.dev

Hsa Eligible Expenses 2024 Pdf Ebba Cissiee What Qualifies As An Expense We have discontinued publication 535, business expenses; Due to the accrual principle in accounting, expenses are recognized when they are incurred, not necessarily when they are paid for. The total of business expenses is subtracted from revenue to arrive at a business' total amount of taxable. This includes money spent on items such as rent, office supplies, and salaries for.. What Qualifies As An Expense.

From www.vencru.com

Expense Report Templates Vencru What Qualifies As An Expense This includes money spent on items such as rent, office supplies, and salaries for. The total of business expenses is subtracted from revenue to arrive at a business' total amount of taxable. guide to business expense resources. Learn more about how you can reduce your taxes today. an expense is a type of expenditure that flows through the. What Qualifies As An Expense.